NB-IoT and LoRa account for 83% share of the LPWAN market, and low-power satellite IoT becomes a game-breaker, In-depth analysis of low-power wide-area (LPWAN) market in 2022.

Low Power Wide Area Network (LPWAN) has been a hot topic in the IoT industry since 2016.

Recently, IoT Analytics, an IoT research firm, released a report showing that although the IoT market is adversely affected by both the new crown epidemic and chip shortages, NB-IoT and LoRa of LPWAN still maintain strong growth.

According to the monitoring of IoT Analytics, in the second quarter and the third quarter of many countries because of the epidemic quarantine, the number of NB-IoT and LoRa of LPWAN-enabled device activation in 2020 still reached 450 million units, with a year-on-year growth rate of 62%, especially in the epidemic prevention and control and supply chain visualization plays an important role in the rapid growth of IoT applications;

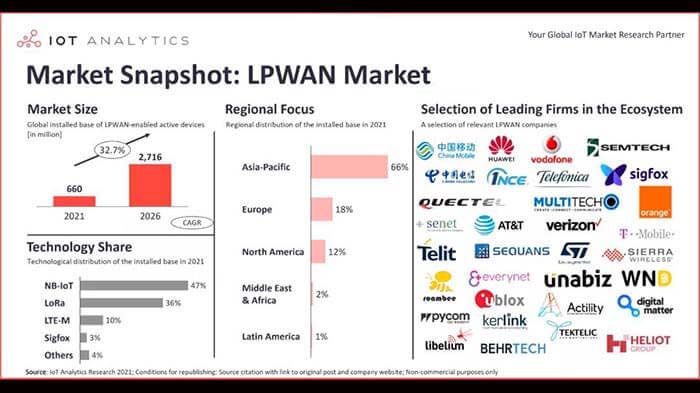

This number is expected to be 660 million in 2022, with a year-on-year growth of 47%, with LPWAN connections expected to reach 2.7 billion in 5 years.

Over the past year or so, there have been some new changes in the global LPWAN space, which are summarized by IoT Analytics. The author combines the domestic reality, as well as the communication with domestic enterprises in related fields, and synthesizes the views of IoT Analytics to analyze from 5 aspects.

First. The "2+2" pattern is further solid, occupying more than 96% of the NB-IoT and LoRa of LPWAN market share

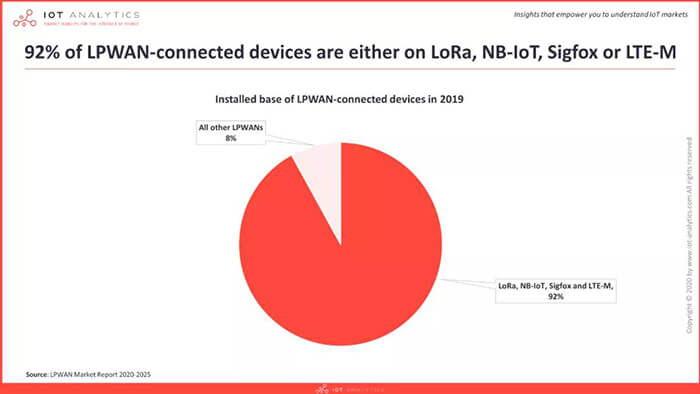

According to IoT Analytics’ monitoring data, the number of NB-IoT and LoRa nodes using these four technologies accounts for more than 96% of all LPWAN nodes.

Specifically, NB-IoT leads with 47% share; followed by LoRa with 36% market share; LTE-M with 10%, and Sigfox with 3%. Thus, the landscape can basically be described as “2+2”, where NB-IoT and LoRa have a clear lead with 83% share, LTE-M, and Sigfox have a small market share, and the remaining technologies are very fragmented with negligible market share.

At the beginning of 2020, IoT Analytics monitoring data shows that the market share held by these 4 types of technologies was 92% in 2019, and 2 years later this share has increased by 2 percentage points. Not only has the concentration increased, but the structure has also changed significantly, with NB-IoT jumping to become the largest technology in the LPWAN space in terms of connectivity size.

In September, data monitored by IoT Analytics for the first six months of 2021 showed that NB-IoT and LTE-M accounted for 54% of the total number of LPWAN connections, surpassing unlicensed spectrum technologies for the first time.

A key factor is that NB-IoT connections achieved a high growth rate of 75% in the first six months of 2021, with NB-IoT connections alone accounting for 44% of LPWAN connections. And as NB-IoT continues to grow at a high rate, its market share is expected to reach 47% by the end of 2021.

LPWAN finally formed a “2+2” pattern, which is the result of the ecosystem operation. These 4 technologies, especially the first 2 categories, NB-IoT and LoRa have a rich ecosystem of members and are supported by a large number of leading companies, both mainstream operators and equipment giants, enabling a wider range of customer choices.

IoT Analytics expects that NB-IoT and LoRa will continue to dominate the LPWAN market over the next five years, with LTE-M and Sigfox in third and fourth place respectively, and that these two categories are unlikely to overtake NB-IoT and LoRa. Other LPWAN technologies, such as Weightless and RPMA, will continue to exist.

There has also been no shortage of new entrants in recent years that have developed new technologies that can serve as alternatives to mainstream technologies for certain vertical applications, but they do not appear to threaten the market leader in the coming years.

Second. The Chinese market is still the largest, but the global market is undergoing some changes.

There is no doubt that the number of LPWAN connections in the Chinese market still accounts for the majority share globally. And the country’s high focus on attention to the digital economy continues to drive the rapid expansion of the IoT scale.

In terms of LPWAN, many industry digitization efforts in China are more widely adopted than in other countries, and over the past few years, China has become the largest adopter in the LPWAN market with the most NB-IoT and LoRa connection nodes.

According to the latest forecast from IoT Analytics, China will have 80% of the global LPWAN connections in 2020 and still reach 76% by the end of 2021.

However, the changing international landscape has led to subtle changes in the global adoption of LPWAN technology. On one hand, while NB-IoT is recognized by mainstream operators worldwide, a large number of overseas operators still choose to deploy LTE-M networks; on the other hand, the market for unlicensed spectrum LPWAN technology in China is starting to slow down due to the continued maturity and cost reduction of NB-IoT.

For example, IoT Analytics noted that Semtech indicated in a 2021 earnings call that while nearly 50% of its current LoRa-related revenue comes from China, the market may change somewhat in the future, with 21% of potential revenue coming from China and 70% from Europe and the Americas.

Third. Smart meters remain the largest NB-IoT and LoRa of LPWAN application scenario, and the epidemic has further increased its penetration.

Smart meters such as water and gas meters are the earliest and by far the largest application scenario in the LPWAN market, both in China and globally. IoT Analytics cites several large smart meter projects that have started or completed LPWAN connectivity in the past two years.

In Europe, more than 1 million or more electricity and gas meters connected via NB-IoT or LTE-M have been installed in countries such as Italy, Sweden, Lithuania, and the Netherlands, respectively.

Birdz France, the Veolia Group’s provider of digital management solutions for water networks, will connect 3 million LoRa smart water meters across France over the next decade, in addition to the 3 million already in operation.

In 2020 China Telecom claims to have more than 20 million smart water meters and over 25 million gas meters connected to its nationwide NB-IoT network. Recently, China Telecom updated its NB-IoT data with more than 42 million smart gas meter connections and more than 32 million smart water connections, both of which are ranked first in the world.

In Saudi Arabia, an NB-IoT smart meter project of over 5 million scales is underway.

In Japan, NICIGAS has completed the retrofit of 850,000 gas meters through Sigfox technology.

During 2020, major IoT vendors say that demand for various types of IoT applications related to fighting epidemics realizes surged, especially those involving measures to control virus transmission and provide supply chain visualization, such as disinfection and cleaning management for the former and food medical cold chain monitoring for the latter.

As an example, NB-IoT door magnets have played a major role in the epidemic, helping to automate the management of isolated sites, and several NB-IoT door magnet vendors have been in short supply or sold out.

Although smart meters are the largest market of LPWAN, domestic and foreign vendors are also trying to explore new areas in recent years. From the domestic market, in addition to water and gas meters, firefighting, white goods, trackers, and other fields are also the direction of further expansion.

Fourth. In the long run, NB-IoT and LoRa of LPWAN IoT connectivity could be a game changer.

In the past few years, several new satellite startups have announced new satellite-based IoT communication systems that promise to significantly reduce the cost and energy consumption of traditional satellite systems.

These satellite communication systems either leverage new IoT airport protocols or existing LPWAN technologies such as NB-IoT and Lora to provide direct communication between IoT devices around the world and satellites in orbit and can be considered part of the low-power wide-area network market.

While most vendors are still in the early market stage, with many still in technology trials and satellite launches, a few have already launched commercial solutions.

These solutions are typically limited to specific customers or specific geographic regions, such as Astrocast, Myriota, and Swarm Technologies (since acquired by SpaceX).

IoT Analytics believes that NB-IoT and Lora of LPWAN IoT technology are not yet proven, so it will take several years for this connectivity market to kick off. In addition, most vendors are rolling out their own proprietary solutions rather than agreeing on specific standards.

However, these solutions have delivered on the promise of traditional satellite solutions at significantly lower costs, enabling ubiquitous network coverage at low cost, and will subsequently become a significant market force in the second half of the 1920s or 1930s.

Of course, satellite IoT will not be a replacement for terrestrial LPWAN, but rather a better integration with terrestrial LPWAN to complement the deficiencies and breakpoints of terrestrial networks with its ubiquitous coverage.

At present, the evolution of 5 G-related standards and 6G standards research have made the integration of air-space-space network convergence the key research direction, which shows that satellite IoT will also become one of the main forces of IoT in the long run.

Fifth. 2G/3G migration to the network brings opportunities, but not according to the expected path progress.

2G/3G migration to the network brings new opportunities for LPWAN, after all, users previously had no choice, and now there are more suitable IoT networks. Several operators around the world have initiated 2G/3G retirement plans, especially 3G networks are being retired at a faster pace. In China, the No. 25 document issued by the Ministry of Industry and Information Technology in May 2020 opened the prelude of 2G/3G migration to the network, followed by rapid follow-up by operators, such as China Mobile, which clearly stopped developing 2G IoT users by the end of 2020.

However, the withdrawal of the 2G/3G network did not bring the expected rapid take-up of LPWAN, and in many regions, the migration was slower than expected.

On the one hand, because 2G network is deep-rooted and has been providing services for nearly 30 years, it is still carrying many voice users and IoT users, such as China Mobile currently has more than 900 million IoT connections, more than half of which are carried by 2G network, and IoT devices have a long life cycle. In this case, 2G can only be withdrawn slowly. Some overseas operators expect 2G networks will continue to serve for many years, and some even expect to exit service in 2030.

On the other hand, LTE Cat.1 has emerged rapidly in the past two years, and with the advantages of an extensive 4G network and low cost, it has taken over a large number of 2G/3G decommissioned IoT connections, indirectly replacing LPWAN to some extent.

This coming 2021, LTE Cat.1 has far surpassed NB-IoT in terms of attention and become the main force for cellular IoT growth.

Of course, LPWAN has been maintaining double-digit growth rates and remains one of the most interesting areas of the IoT market, and as the simplest and lowest cost, wide-area IoT solution available is bringing digital opportunities to a large number of industries. There is no shortage of innovators in this market, nor will it create a winner-take-all landscape.

While NB-IoT is further consolidating its leadership position, unlicensed spectrum technologies such as LoRa and Sigfox are also demonstrating their ability to respond quickly to market demand and serve customers, together with driving the IoT market to flourish.

C&T RF Antennas Inc manufactures NB-IoT and LoRa antennas and other IoT antennas, contact us for more antenna specifications.

You may also be interested in the below articles.

What is the difference between WIFI and WLAN?

Summary of 41 Basic Knowledge of LTE

What Are The Advantages And Characteristics Of NB-IoT And LoRa?