Today, we are going to talk about the 5G-Advanced innovation’s dual-chain integration, five major forces, and three driving factors.

The previous “5G-Advanced Action Plan” contains three major goals, one is an excellent network, the other is intelligent life and intelligent simplicity, and the third is low-carbon and high efficiency. It also proposes a new paradigm of the innovation chain, industrial chain, dual-chain integration, and coordinated development.

The subsequent “5G-Advanced Evolution White Paper” analyzed the 5G-Advanced network evolution architecture and technology development trends in detail for the first time, and strived to point out the direction to promote 5G to generate greater social and economic value.

In order to allow 5G to enter a wide range of industries and promote the emergence of 5G-Native native applications, the plot of this episode can be described as gathering together on the bright top.

Everyone proposes that 5G will further integrate DOICT (DT, OT, ICT) and other technologies. Continue to innovate in 6 directions, including architecture, uplink enhancement, full-scenario Internet of Things, synesthesia, L4 autonomous driving network, and green and low-carbon, achieving a capacity improvement of more than 10 times.

The importance of 5G-Advanced is unquestionable, and we need to understand it deeply.

5G shoulders too many missions. In order to make this life well, its own complexity is becoming unprecedented. If you consider the competition or mix and match from industrial Ethernet, WiFi-6, LoRaWAN, satellite Internet, and other communication technologies, the Internet of Things connection is dazzling.

Behind the evolution and gaming of communication technologies such as 5G are the results driven by various forces from multiple types of companies, involving many non-technical factors such as industrial thinking, competitive landscape, and business models.

So in today’s article, let’s first define the key evolution direction of 5G-Advanced, and try to explore the upcoming changes in the industrial landscape with the evolution of 5G:

What are the key points of 5G-Advanced?

How to find the positioning of the enterprise in the changing situation?

Where are the opportunities for changes in the industrial structure?

1. What are the key points of 5G-Advanced?

The current plagued by epidemic does not prevent the global commercial deployment of 5G from being in full swing.

As of April 2021, 162 5G networks in 68 countries and regions have been commercially released. According to GSMA’s forecast, the number of 5G connections will increase from 200 million in 2020 to 1.8 billion in 2025 in the next five years.

Everyone is aware that the next 3 to 5 years will be a critical period for the development of 5G. The 3GPP experts who shoulder heavy responsibilities are working hard day and night for the advent of 5G-Advanced communication technology, with dark circles under their eyes.

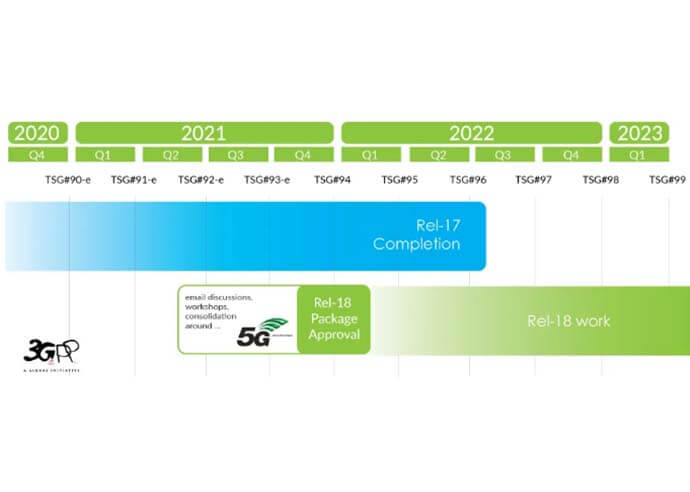

From June 28th to July 2nd, 3GPP held its first internal seminar on Release 18. More than 500 companies and institutions participated in the presentation and demonstration. All parties started to gradually improve the framework and enrichment of 5G-Advanced from R18 content. This marks the start of the R18 approval process, which is expected to be completed at the plenary meeting in December.

Two months ago, on April 27, the 46th 3GPP project cooperation group meeting was held, and the name of 5G evolution was officially confirmed as 5G-Advanced. At the same time, the meeting decided that 5G-Advanced will start from R18, and the R18 version is expected to be frozen by the end of 2023.

It can be seen that the significance of 5G-Advanced is extraordinary.

Unlike previous generations of communication networks, 5G is considered to be the cornerstone of the industry’s digital transformation. Therefore, the “5G-Advanced Network Technology Evolution White Paper” proposes that the follow-up evolution of 5G networks, 5G-Advanced, needs to be studied, and fully considered architecture evolution and function enhancement.

The white paper believes that in the process of end-to-end 5G-Advanced network evolution, the evolution of the core network plays a pivotal role. 5G-Advanced networks need to continue to evolve from the network architecture level and the network technology level to meet diversified business demands and improve network capabilities.

In terms of network architecture, the 5G-Advanced network will develop along with the concept of cloud-native, edge network, and network-as-a-service, continue to enhance network capabilities and eventually move toward cloud-network integration and computing-network integration.

Cloud-native

This is a particularly popular concept now. We also introduced the connotation of cloud-native in the previous article, but everyone’s mind may be different from cloud-native.

This refers to the further cloudification enhancement based on the network function virtualization of the telecom cloud, so as to realize the flexible deployment of 5G networks and the flexible development and testing of functions more quickly.

Edge network

This is an efficient deployment form that combines distributed network architecture with edge services.

Network as a service

This model makes the 5G system highly flexible and can adapt to various customized solutions for the needs of vertical industries. The specific implementation form can be 5G network slicing or independently deployed networks.

In terms of network technology, 5G-Advanced network capabilities will continue to be enhanced along with the three aspects of “intelligence, integration, and enablement” to provide industry users with customized networks on-demand to meet future users’ complex and diverse needs for networks.

Wisdom

As 5G network functions and management become more complex, traditional networks require a lot of manual configuration and diagnosis, which brings high management overhead. Therefore, intelligence needs to be introduced to help improve services at all levels from network functions to network management collaboration Capacity and quality of service.

Convergence

The convergence of multiple access methods and multiple networks is the direction of 5G-Advanced network evolution. The integration of world and earth, industrial Internet, and other multi-industry and multi-protocol integration of next-generation networks have become a new trend.

Enablement

5G is gradually evolving from infrastructure to the role of service enabler. 5G-Advanced will better provide industry users with on-demand customized networks and truly realize network as a service.

Although 5G is widely valued, the existence of other IoT connection technologies cannot be ignored.

From the perspective of the industry, 5G is an option, but not the only option. Industry users hope that they cannot feel the switching between communication technologies at all, but that a single network can solve various problems such as call, transmission, and control.

The solution to 5G is integration and enhancement.

Convergence includes 5G and industry network convergence for 2B vertical industry customers, home network convergence for 2H smart life IoT, and world-ground integration network convergence for satellite communications.

More enhancements include enhanced interactive communication capabilities, enhanced deterministic communication capabilities, user plane evolution, network slicing enhancement, positioning and ranging and perception enhancement, multicast broadcast enhancement, and policy control enhancement.

The “5G-Advanced Action Plan” proposes a new paradigm of “dual-chain integration”.

Double chains, one is the innovation chain, and the other is the industrial chain. New technology cannot generally be promoted and implemented by only one company, let alone as complicated as 5G.

The innovation chain refers to the joint innovation of various partners to continuously build, expand and activate technological innovation. The industrial chain refers to the concerted efforts of all parties in the industry to further lower the threshold and enrich the industrial terminals.

Through the mutual promotion and integrated development of the innovation chain and the industrial chain, the development of 5G applications will be promoted.

How to find the positioning of the enterprise in the changing situation?

There are so many forces entering 5G, and the source is unprecedented.

In the past, the wireless communications market had a relatively simple structure, and equipment vendors, operators, and industry users built an ecosystem. When the number of connections progresses from one million to one billion, quantitative changes trigger qualitative changes, and the ecosystem is in a state of change.

Important participants come from 5 forces, including communication equipment vendors, telecom operators, cloud service providers, end-users, and innovative companies.

Communication equipment vendors have the resources, capabilities, and experience required to provide 5G private network equipment and services, and can directly reach industry users.

In the past, communication equipment manufacturers served industry users through indirect ways of cooperating with operators, but this kind of cooperation can now be reached directly. A typical example is Nokia, which has taken the 5G private network as its core product and has won multiple 5G private network contracts worldwide.

Recently, Nokia has deployed a commercial 5G private network at its factory in Hamburg, Germany, for the aircraft service provider Lufthansa Technology. The 5G network allows Lufthansa to perform virtual engine component inspections for its civil aviation customers through fast, high-definition video connections.

In fact, this layout has been planned for a long time. In 2019, Nokia has estimated that there are nearly 15 million companies and places in the world that have potential 4G and 5G private network needs.

The UniCell5100 cloud-based small base station launched by New H3C is adapted to the indoor needs of industry users. Whether it is a factory, a hospital, a station, or an airport, a large number of 2B services will occur indoors in the 5G era, and indoors will be a key-value scene in the 5G era.

In contrast, the higher frequency 5G signal is difficult to penetrate the wall to reach the room. On the one hand, there is a huge increase in business demand, and on the other, there is a signal blind zone, which of course will promote a substantial increase in the demand for 5G indoor sites. New H3C has keenly captured this business opportunity.

The cooperation between telecom operators and industrial users has a long history, and they took the lead in investing and deploying 5G industry applications.

Major operators have released solutions for industry users.

Of course, users need to pay for connections. This is the cheese in the pockets of telecom operators. However, with the growth of the connection level, the characteristics of economies of scale make these connections cheaper and cheaper.

According to GSMA’s research, connections will eventually account for less than 5% of the IoT value chain, while the remaining 95% will be reflected in the form of professional services, such as applications, platforms, or hybrid forms that include other services.

The value of the entire industry will be transferred to the operation and application part of the Internet of Things. 5G provides operators with an excellent opportunity to break away from the limitations of pipelines and move to the upper end of the value chain.

Clear strategy, effective investment, and correct strategic partners are particularly important for operators at this time. Therefore, some operators are trying to open RAN architecture to reduce operation and maintenance costs.

A typical example is the Japanese technology giant Rakuten announced this week that it has reached an agreement to acquire Open RAN supplier Altiostar Networks for more than $1 billion.

In China, China Mobile, Bai Caibang, and Intel jointly conducted technical experiments on the wireless intelligent controller RIC, supporting the introduction of AI to optimize the wireless network and promote the automation and intelligence of the network.

Cloud service providers are partly from Internet companies and partly from IT companies. In the 5G era, they have repositioned themselves and debuted with new roles.

Companies such as AWS, Microsoft, Google, and Ali have all launched edge computing or core network solutions, gradually sinking with the advantages of cloud services, and further penetrating cloud capabilities to the last meter of the industry.

Especially in the past period of time, the epidemic has increased the demand for salinization, and cloud service providers have accelerated the rise of 5G networks and business models. These companies have cloudification capabilities and are also selling cloud core networks. AWS, Google Cloud, and Microsoft Azure have all made considerable gains in this regard.

For example, Google Cloud cooperated with AT&T to build a new business service platform with the help of 5G. Google Cloud has also established partnerships with companies such as Ericsson and Nokia to jointly develop and sell cloud-native network functions, 5G edge services, and 5G core network products for mobile operators.

AWS is working with telecom operators such as Verizon, Vodafone, SK, and KDDI to embed AWS computing and storage services at the edge of telecom operators’ 5G networks, enabling developers to serve application scenarios that require ultra-low latency.

The sign of Microsoft’s entry into 5G is that through the acquisition of Affirmed Networks and Metaswitch Network, it has completed its strategic layout from edge computing to core network to carrier-grade software.

You can think of the 5G network as a key, which can help us unlock real-world scenarios that were previously difficult to digitize, allowing digital technology to reshape the real world with a smaller granularity.

In 2020, Tencent’s 5G ecological plan has introduced 45 5G innovation partners, including listed companies in industries such as Quectel, Boshi Automation, and Future Magic School, as well as such as Chaiyi Technology, Versa, Haima Cloud, and Xunce Technology. , Mega, and other leading innovative companies.

Considering that 70% of 5G investment is access network, which is not what cloud service providers are good at, of course, it is not ruled out that cloud service providers who are not bad at the money will continue to use buying methods to complement this ability.

Industry giants, currently mainly exist as 5G users, and they are the targets of private network applications, but they do not rule out the potential of turning around and providing 5G services to the outside world.

In the industrial Internet field, industry giants initially appeared as users, and gradually cultivated platform-based service capabilities to empower industry users.

In the 5G era, industry giants have also eagerly launched various private network demonstrations. Haier, Gree, Zhenhua Heavy Industry, Baosteel, and other companies have all carried out pilot deployments of 5G private networks.

Relying on their deep cultivation of vertical industries, they understand the urgent needs and pain points of industry enterprises for digital transformation and refine and output their own capabilities.

Start-ups, in the 5G era are easy to form a flywheel effect. The more customers and the more data they collect, the better the product solutions will be improved, which further promotes the accumulation of customers.

In a typical enterprise such as floLIVE, the company provides 5G cloud core network solutions based on a software-defined cloud-native framework connecting SDC, which can support a variety of scenarios from a single campus to multinational services.

Such innovative companies are still emerging.

Where are the opportunities for changes in the industrial structure?

Behind the evolution of 5G-Advanced and the entry of various forces are industrial thinking, competitive landscape, and changes in business models. These factors are often not related to technology.

Since industry users are the ultimate users of 5G applications, their behavior is a core variable that affects the evolution of 5G, including the following three driving factors:

Industry users have gradually begun to directly incorporate 4G and 5G patent fees into their costs.

An interesting piece of news is that in June of this year, Daimler and Nokia finally ended their protracted dispute over arrears. The two parties have reached a patent license agreement and Daimler agreed to pay Nokia a royalty.

Generally, the cost of such patents on automobiles is that technology companies issue licenses for related parts to auto parts suppliers, and then the parts suppliers go to the auto manufacturer to calculate the cost.

But this time, Nokia charged the automaker directly and implemented it in accordance with the standard of 15 US dollars per car.

Audi, Bentley, BMW, Mini, Porsche, Rolls Royce, SEAT, Skoda, Volkswagen, and Volvo have all paid Nokia royalties.

The patent licensing model is not only applicable to cars, but also covers many other products that use wireless connections, whether it is refrigerators, industrial hardware, or medical equipment.

Industry users began to directly participate in the formulation of 3GPP standards and were active in various 5G organizations.

Whether it is 3GPP, GSMA, or the 5G Slicing Alliance for which I am the secretary-general, they all face the enthusiasm of industry users for participation. Typical examples are Airbus, Siemens, Bosch, Mitsubishi, and Hyundai.

When we talk about the entry of 5G into thousands of industries, there will naturally be some leaders, even early runners, who will take the initiative to think about how to use 5G technology to empower industry transformation, and will actively join and drive 5G standards and ecological changes.

The participation of these companies has enabled the communication requirements and application tendencies of industrial scenarios to be reflected in 5G-Advanced.

In terms of 5G applications, these leaders also act frequently.

The world’s first industrial private 5G network built by Siemens and Qualcomm has been put into use at the Nuremberg plant in Germany.

The Bosch Group also announced the ctrlX automation platform. The operating system, control software, and automation equipment within the framework of the platform will all be compatible with the 5G communication standard.

Industry users have shown great interest in purchasing and renting the 5G spectrum.

Although foreign operators have complained because the 5G spectrum auction price is too expensive, in the eyes of industrial giants, building a private 5G network is quite cost-effective. Therefore, in Germany, more and more industrial giants are beginning to apply for private 5G frequency bands.

According to data calculated by Mugler, a 5G consulting company, in 2019, a production factory covering an area of 30,000 square meters, to build a private 5G network, the 10-year average cost is about 2880 euros/month, of which the operating cost is about 1500 euros/ moon.

Taking the basic package given by Deutsche Telekom in September 2019 as an example, if the factory chooses the public 5G network provided by the operator, the monthly rental fee is about 1,000 euros, which is 500 euros cheaper than the private 5G network, but the price that the company has to pay Yes, the signal in the factory building cannot be strengthened, the number of connected terminals is not more than 20, and the server and data are stored in the operator’s server.

In the past year or so, Germany and Japan have issued special policies for the frequency of 5G private networks in vertical industries and reserved special frequency bands for 5G private networks. A dedicated 5G network has been built and operated by leading German and Japanese companies such as Siemens, Bosch, Mercedes-Benz, Fujitsu, NEC, etc.

In this context, domestic calls for the allocation of dedicated frequencies for 5G industries have also continued to appear.

Since the beginning of the commercial use of 5G, discussions on my country’s 5G industrial private network have always been a key topic. Some vertical industries, especially leading industrial companies, have also made it clear that they hope to build their own 5G private networks.

At present, China has not issued enterprise 5G dedicated spectrum, and enterprise 5G private network construction is carried out in cooperation with operators.

Judging from the current domestic 5G policy, the industry is still focusing more on the provision of 5G virtual private networks, which are also formed on the basis of taking full advantage of 5G infrastructure, achieving economies of scale, and preventing frequency fragmentation.

On the basis of the 5G virtual private network application experience, the timely launch of the 5G independent private network is a better path.

With the advent of the 5G era, telecom operators and industry users have stated that it is only a matter of time before the potential of 5G can be realized.

Industry users are particularly optimistic about the emerging standard of 5G, which is the conclusion of a survey of 141 companies this year.

Respondents believe that LTE or Wi-Fi cannot meet their current industrial needs, and people agree that 5G is more suitable for industrial applications. 28% of the interviewees believe that performance advantages force 5G to be preferred for scenarios requiring wireless in industrial networks.